Shares in Gulf Keystone Petroleum (GKP) were trading up 3 percent on Monday after the company provided an operational and corporate update on its operations in Iraqi Kurdistan.

Analyst Peel Hunt has reportedly re-issued its “Buy” rating during the morning.

Operational

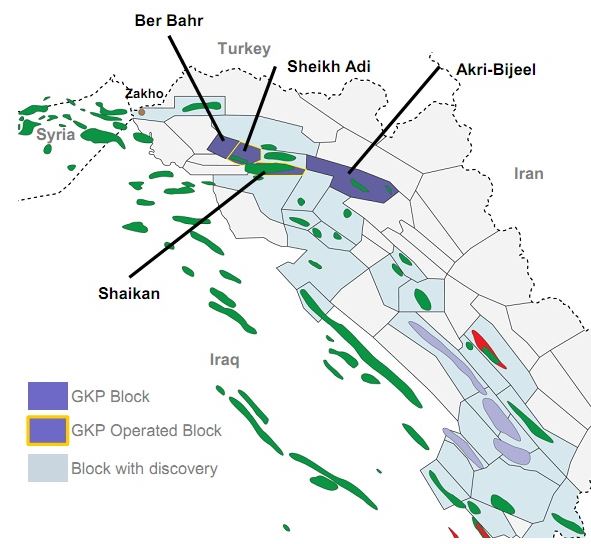

- Operational activity continues at the Shaikan Field (pictured) to complete the debottlenecking programme in 2019, in order to achieve the near-term production target of 55,000 bopd in Q1 2020

- Progress is continuing with the export pipeline from PF-1 to the main export pipeline, which remains on schedule to become operational mid-year, at which point trucking of crude oil will be eliminated

- The SH-1 workover to replace the existing tubing with larger bore tubing, has now been successfully concluded. The result was positive with an increase in production from the well of approximately 50% to over 6,500 bopd

- The IOT Rig 1 has been demobilised. It will now complete a short workover for another operator nearby before returning to Shaikan for the remaining workovers in the 55,000 bopd expansion programme. This will include the SH-3 tubing change-out, along with installation of Electric Submersible Pumps (“ESPs”) in wells SH-5, SH-10 and SH-11

- DQE’s Rig 40 is currently being prepared ahead of the imminent Jurassic drilling campaign, which remains on schedule to be mobilised for the SH-H well later this month

Corporate

- A renewal of the crude oil sales agreement has been signed between Gulf Keystone Petroleum International Ltd and the Kurdistan Regional Government (“KRG”)

- The KRG will purchase Shaikan crude oil directly injected at PF-2 into the Atrush export pipeline at the monthly average Dated Brent oil price minus a total discount of c.$21 per barrel for crude

- Until the PF-1 pipeline is completed, the KRG will continue to purchase crude oil delivered by truck at a discount of c.$22 per barrel

- The above discounts account for quality, domestic and international transportation costs

- The agreement is effective from 1 January 2019 until 31 December 2020

- The Company has received final clearance from Sonatrach in relation to the Ferkane Permit (Block 126). This officially marks Gulf Keystone’s exit from its Algerian operations.

- This positive development will allow the Company to release $10 million of past liabilities

Outlook

Despite Q1 production having been affected by SH-1 being offline for the workover, and the export system being shut-down for maintenance for a week earlier this month, the Company maintains its 2019 gross average production guidance in the range of 32,000 – 38,000 bopd

(Sources: GKP, Yahoo!, Financial Headlines)