By Ahmed Mousa Jiyad.

Any opinions expressed are those of the authors, and do not necessarily reflect the views of Iraq Business News.

Monetization Strategies for Joint Development of Border Fields in MENA Region

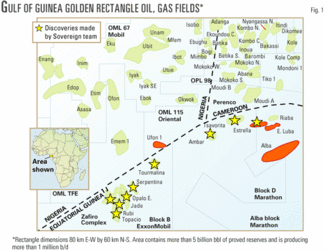

Many hydrocarbons fields and exploration blocks, with billons barrels of petroleum, straddle sovereign borders (both onshore and offshore) in the Middle East and North Africa- MENA region, present significant development opportunities as well as potentially risk and source of conflict.

So far, they have been mostly source of conflicts, contentious and acrimonious relationship; it’s about time to pursue the other mutually beneficial approach whenever possible and feasible.

The number, prospects and potential of border fields in MENA Region indicate to billions barrels of oil equivalent -BOEs of proven hydrocarbon (oil, gas and condensates) reserves, with more to add through further exploration and technological advancement, generating billions of cash flows with attractive returns on investment.

Brief examples and as of today’s data and information are the following:

- Iraq has (24) border oilfields with Iran, Kuwait and Syria;

- Iran has (23) border fields/blocks with Iraq, Saudi Arabia, Kuwait, Qatar, UAE, Oman and Turkmenistan;

- Arabian Gulf Region is crowded with too many structures, including Saudi Arabia-Kuwait Neutral Zone (Al-Khafji & Al-Wafra);

- The Mediterranean: Lebanon vs. Occupied Palestine (Israel); Cyprus vs. Turkey; Egypt vs…..!!

- Red Sea: Egypt vs, Sudan (Halayib and Shalateen)

- Other MENA countries…….

Empirical evidence and analytical premises suggest that sovereign border hydrocarbons fields or exploration blocks could be developed either through “competitive” or “collaborative” strategies; the first follows “rule of capture” or “use it before losing it”, while the second adopts “feasibility & optimization”; the first is harmful to the field, its structure and reservoir(s) while the second adheres to efficiency considerations, prudent natural resource management and international best practices; the first is premised on “sovereign exclusivity” while the second is formulated on “Bi/trilateral inclusivity”; the first is “conflict-prone” while the second serves “mutuality of interests”; the first is “short-term focused” while the second has “phasic orientation” and finally, from investment vs. net revenue perspectives, the first is “own-risk” while the second is “burden and benefit-sharing”.

What should be highlighted is that collaborative development of a border field could be done through two broad (comprising various versions) distinct modalities with different investment, revenue structures and legal modalities: unitization (mostly trilaterally structured) or joint venture (mostly bilaterally structured).

For this purpose the presentation proposes TELG Approach for monetizing these resources, which basically integrates four fundamental broad spheres of professional knowledge-base and analysis and the needed institutional, managerial and governance setups applicable to the collaborative mode of border fields development in both modalities- unitization and joint venture.

TELG Approach is helpful for unitization requirements of both onshore and offshore across-sovereign borders as well as across contracted areas within each country.

After discussing the essence of cross-border fields exploitation as “Hotelling game”, basic contesting strategies, phases of unitization agreements and elaborate on TELG approach and its requirements, the presentations provides examples on the “ambiguity” of legal provisions on unitization in the Iraqi service contracts, the July 2019 Iraq-Kuwait contract with ERCE and a list of modalities governing UK-Norway unitization of fields.

The presentation ends with call upon Arab related entities such as OAPEC, ESCWA and the Economic and Social Council of the Arab League among others to take necessary and serious measures to address unitization, and request Arab petroleum professionals to produce international best-practice guide and formulate basic model for unitization agreement in efforts to help in efficient exploitation of such natural resources in a prudent and effective way and finally provide Illustrative Hypothetical Case for Unitization Negotiation Game.

This presentation was delivered before the 12th Middle East and North Africa Oil & Gas Conference, organized by Target Exploration at Imperial College, London, UK. 19 September 2019; I am very grateful to Target Exploration for sponsoring my participation.

Click here to download the PowerPoint slides presented at the conference.

Mr Jiyad is an independent development consultant, scholar and Associate with the former Centre for Global Energy Studies (CGES), London. He was formerly a senior economist with the Iraq National Oil Company and Iraq’s Ministry of Oil, Chief Expert for the Council of Ministers, Director at the Ministry of Trade, and International Specialist with UN organizations in Uganda, Sudan and Jordan. He is now based in Norway (Email: mou-jiya(at)online.no, Skype ID: Ahmed Mousa Jiyad). Read more of Mr Jiyad’s biography here.